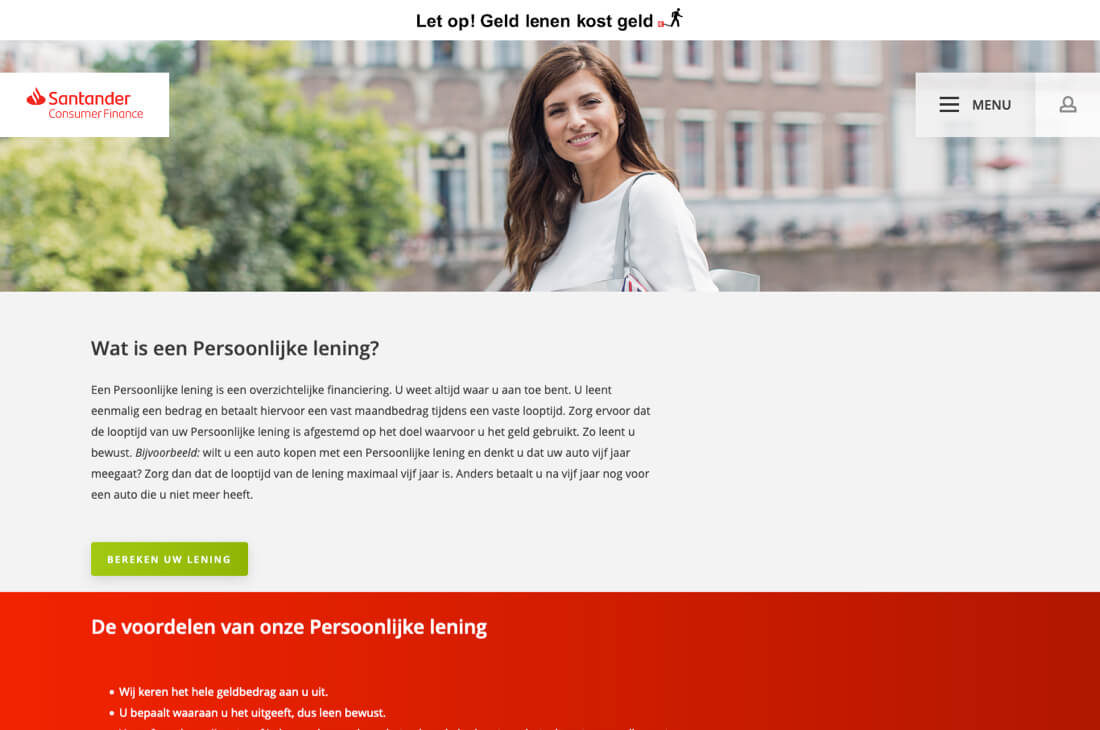

Santander Personal Loans: Streamlined Financing for Your Life’s Milestones

Introduction to Santander’s Personal Lending Services

Santander, a name synonymous with reliability and trust in the financial sector, has been facilitating personal dreams and financial goals since 1992. Through its dedication to providing secure, dependable, and straightforward lending solutions, Santander has successfully issued over 2.5 million loans, marking a significant milestone in its journey of financial service excellence. This introduction aims to shed light on the various aspects of borrowing with Santander, emphasizing the seamless blend of online convenience, personal customization, and unwavering reliability that sets its services apart.

Why Choose Santander for Personal Loans?

Santander’s approach to lending is rooted in three core principles: online accessibility, reliability, and personalized service. These principles are designed to ensure that every customer finds a lending solution that perfectly matches their needs while ensuring ease of access and peace of mind.

- Online: Santander has embraced the digital age, allowing customers to apply for loans online. This 24/7 accessibility ensures that financial support is always just a few clicks away, catering to the modern borrower’s need for immediacy and convenience.

- Reliable: Every loan application process is transparent, with loan offers sent directly via email. This allows customers to consider their options without pressure, ensuring they make informed decisions about their financial futures.

- Personal: Understanding that every financial scenario is unique, Santander goes the extra mile by offering customized loans. By contacting applicants directly, Santander ensures that each loan is tailored to meet individual requirements, reinforcing its commitment to personal touch in its services.

Loan Purposes Catered by Santander

Santander’s lending solutions cover a wide array of needs, ensuring that whether it’s a significant purchase, consolidating debts, or financing a home renovation, there’s a tailored financial solution available. The main categories include:

- Large Purchases: For those big moments in life that require substantial financial backing, Santander’s large purchase loans offer the necessary funds with terms that suit your financial landscape.

- Debt Consolidation: Simplifying financial management by consolidating existing loans into one manageable loan, Santander helps customers streamline their finances and potentially lower their interest rates.

- Home Renovations: Funding your home improvement projects is easier with Santander, enabling you to enhance your living space without financial strain.

Managing Your Loan with My Account

Santander’s “My Account” platform exemplifies its commitment to convenience and security, offering customers 24/7 online access to their loan details. This platform allows users to:

- Manage Loans Anytime, Anywhere: With round-the-clock access, customers can easily check balances, download statements, and stay informed about their loans without constraints.

- Santander App: For even greater convenience, the Santander App brings all the functionalities of “My Account” to your mobile device, allowing for secure management of your finances on the go.

Santander Personal Loans: Simple, Reliable, and Convenient

Santander has established itself as a trusted provider of personal loans, offering straightforward and reliable financial solutions tailored to meet various needs. Whether you’re considering a major purchase, a home renovation, or consolidating existing loans, Santander’s personal loan service is designed to provide the financial support you need with the simplicity and reliability you deserve.

Key Features of Santander Personal Loans

- Immediate Funding: Receive the entire loan amount in one lump sum.

- Fixed Interest Rate: Benefit from a fixed interest rate throughout the loan term.

- Transparent Repayment Schedule: Know exactly how long it will take to repay the loan.

- Online Application: Apply for a personal loan anytime, anywhere, with Santander’s easy online process.

Overview of Santander’s Personal Loan Service

| Feature | Detail |

|---|---|

| Loan Amounts | Starting from €2,500 |

| Interest Rate | Fixed, ensuring predictability and stability |

| Repayment Term | Clearly defined, allowing for structured financial planning |

| Application Process | Online, accessible 24/7 for convenience |

| Loan Purpose | Versatile, suitable for large purchases, debt consolidation, home improvements, and more |

Advantages of Choosing a Santander Personal Loan

- One-time Lump Sum: Get the full loan amount deposited directly into your account.

- Fixed Monthly Payments: Know exactly what you’re paying each month, without any surprises.

- Clear Repayment Timeline: Understand precisely how long you’ll be repaying the loan.

- Stable Interest Rates: Enjoy a fixed interest rate that’s not subject to market fluctuations.

- Tax Benefits: Potentially deduct interest payments from your taxes under certain conditions when financing home improvements.

Considerations for a Personal Loan

While personal loans from Santander offer numerous benefits, it’s important to consider the following:

- Fixed Loan Amount: The amount borrowed is fixed and cannot be adjusted once the loan is disbursed.

- Less Flexibility: Unlike revolving credit, you won’t have ongoing access to additional funds.

- Early Repayment Charges: Paying off the loan early may incur additional costs.

- Fixed Repayment Term: The loan term is set at the outset and cannot be altered.

Tariffs and Conditions

| Loan Amount (€) | Monthly Payment (€) | Interest Rate (Fixed)* | Term (Months) | Total Repayable (€) |

|---|---|---|---|---|

| 2,500 | 50 | 14.0% | 72 | 3,630.24 |

| 5,000 | 74 | 13.5% | 120 | 8,863.20 |

| 12,500 | 178 | 12.5% | 120 | 21,379.20 |

| 25,000 | 356 | 12.5% | 120 | 42,758.40 |

| 50,000 | 713 | 12.5% | 120 | 85,515.60 |

*Rates as of 18 September 2023. These examples are illustrative; actual rates may vary based on individual circumstances.

How to Apply for a Santander Personal Loan

- Calculate Your Loan: Determine how much you need to borrow and what your repayments might look like.

- Submit Your Application: Fill out the online application form to get started.

- Review Your Offer: Santander will send you a loan offer via email for your consideration.

- Finalize the Loan: After reviewing your documents and completing any necessary checks, Santander will finalize the loan and disburse the funds.

Conclusion

Santander’s personal loan service combines ease, reliability, and flexibility, making it an ideal choice for individuals in need of financial support for various life projects. With clear terms, a straightforward application process, and the backing of one of the financial industry’s most reputable names, Santander personal loans provide a solid foundation for achieving your financial goals with confidence and peace of mind.