Borrowell: Empowering Canadians with Free Credit Knowledge

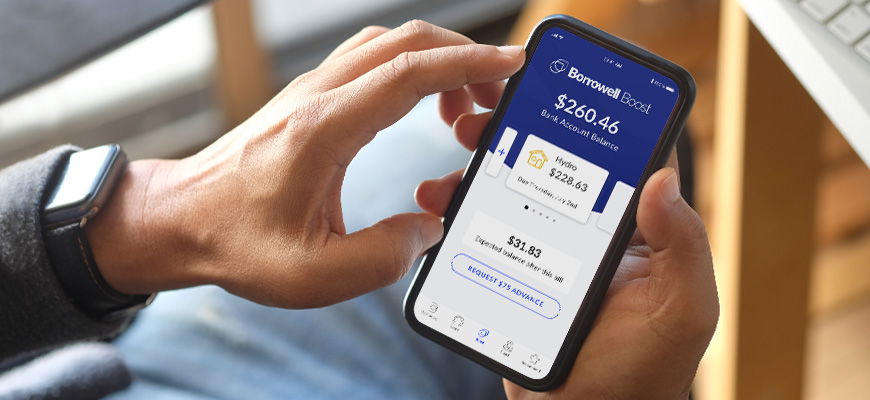

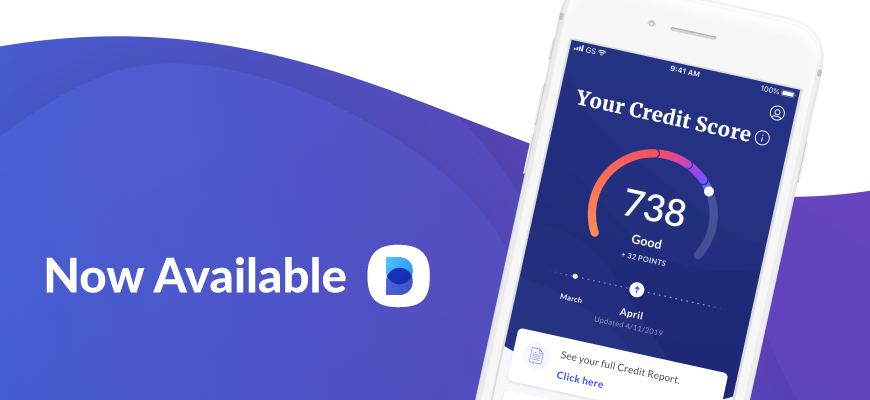

In the financial landscape of Canada, Borrowell shines as a trailblazer, offering Canadians a seamless avenue to access their credit scores and reports for free. Beyond just numbers, Borrowell equips its users with personalized tips, tools, and financial product recommendations, setting a foundation for informed financial decisions and healthier credit lives.

Elevating Financial Wellness with Borrowell

Borrowell’s commitment to financial wellness is evident in its comprehensive suite of tools and resources designed to empower Canadians. By providing users with free access to their credit score and report, Borrowell sets the stage for financial transparency and empowerment. However, its value extends far beyond this initial offering.

Personalized Financial Journey

At the heart of Borrowell’s platform is a personalized user experience, where financial recommendations are tailored to the individual’s credit profile. This bespoke approach ensures that users are not just presented with options but are guided towards choices that align with their financial goals and circumstances.

A Catalyst for Financial Education

Education is a cornerstone of Borrowell’s mission. Through a combination of AI-driven insights and expertly crafted content, users receive a holistic education on credit health. This initiative demystifies the credit system, making it accessible and understandable for the average Canadian, thereby promoting better financial decisions.

Comprehensive Financial Ecosystem

Pros:

- Accessibility: Free and instant access to credit scores and weekly reports.

- Educational Resources: Provides valuable insights into improving credit health.

- Security: Utilizes bank-level encryption to ensure user data protection.

- Customized Recommendations: Offers personalized financial product suggestions.

Cons:

- Product Limitation: Recommendations limited to partner institutions.

- Frequency of Offers: Some users might find frequent product recommendations intrusive.

Benefits: Borrowell’s mission extends beyond free credit checks. It’s about empowering Canadians to take control of their financial health with comprehensive tools and insights. The platform’s holistic approach towards credit education makes it a vital ally in financial planning and decision-making.

Why Choose Borrowell Over Competitors

Borrowell stands out by being the first Canadian company to offer free credit scores. Its dedication to fostering financial literacy through AI-powered coaching, weekly updates, and personalized financial products carves its niche in the fintech industry.

Comparative Feature Table

This table highlights Borrowell’s unique positioning as a leader in financial literacy and personalized financial services in Canada. Unlike generic financial services, Borrowell offers an ecosystem designed for education, empowerment, and personal growth in financial management.

| Feature | Borrowell | Generic Financial Services |

|---|---|---|

| Free Credit Monitoring | Weekly | Often Monthly |

| AI-Driven Financial Coaching | Yes | No |

| Personalized Product Recommendations | Extensive | Limited |

| Financial Literacy Resources | Comprehensive | Basic |

| User Security | Bank-level 256-bit encryption | Variable |

| Community Impact | High (via financial literacy promotion) | Low |

| User Base | 3 million+ | Variable |

In Conclusion: A Beacon of Financial Literacy

Borrowell transcends the traditional boundaries of fintech by embedding credit education at its core. It’s not just about monitoring numbers; it’s a dedicated partner in navigating the complexities of credit health. For Canadians looking to demystify their credit scores, make informed financial decisions, and explore tailored financial products, Borrowell represents a comprehensive, secure, and empowering solution.